Bullish Possibility:

In my last post and earlier post I mentioned that,

Quote

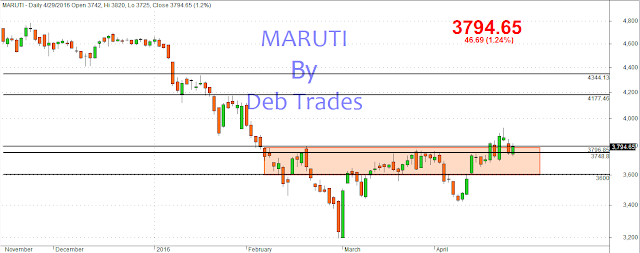

Zooming on it's last 2 months chart we find that 3800 is a solid resistance from where it fall couple of time making this resistance a significant one. Now in coming week if this stock able to float above this resistance level then can move quickly to 4443 approx due to inverse H&S effect.

Unquote

The above view remains the same till now. Last to last week we had a false breakout above 3800 level and last week it just keep on oscillating around this level making the traders life miserable. But as much as we sweat now, the fruit of patience is sweet when it comes. In the above chart we find that below 3800 Maruti is in consolidation range and starting from Feb 2016 it spent most of the time in 3600-3800 zone. So have patience when we will have breakout the first target would be 4177 and next one would be 4340 approx.

Bearish Possibility:

Maruti will be bearish only below 3600.

Summary:

1) Maruti is bullish above 3800. Above 3800 1st target 4177 and next one 4340 approx.

2) Maruti in consolidation range in 3600-3800. This can also be a no trade zone for positional traders.

3) Short Maruti Stock below 3600 with target of 3460-3416-3391-3358.

Final Words:

If you like this post do share it and leave your comment. Any question related to the topic? Feel free to ask.

Trade safe and keep checking this space for any further updates on developing resistances in between. Also check out our other publications on Nifty, Bank-nifty and other stock specific at the left hand column. You can also visit my masters (Ilango) blog for daily updates on Nifty. Happy Trading. As my mater says, Get Rich Slowly and Quietly. Cheers!!

In my last post and earlier post I mentioned that,

Quote

Zooming on it's last 2 months chart we find that 3800 is a solid resistance from where it fall couple of time making this resistance a significant one. Now in coming week if this stock able to float above this resistance level then can move quickly to 4443 approx due to inverse H&S effect.

Unquote

|

| Maruti Daily Chart by Deb Trades |

The above view remains the same till now. Last to last week we had a false breakout above 3800 level and last week it just keep on oscillating around this level making the traders life miserable. But as much as we sweat now, the fruit of patience is sweet when it comes. In the above chart we find that below 3800 Maruti is in consolidation range and starting from Feb 2016 it spent most of the time in 3600-3800 zone. So have patience when we will have breakout the first target would be 4177 and next one would be 4340 approx.

Bearish Possibility:

Maruti will be bearish only below 3600.

Summary:

1) Maruti is bullish above 3800. Above 3800 1st target 4177 and next one 4340 approx.

2) Maruti in consolidation range in 3600-3800. This can also be a no trade zone for positional traders.

3) Short Maruti Stock below 3600 with target of 3460-3416-3391-3358.

Final Words:

If you like this post do share it and leave your comment. Any question related to the topic? Feel free to ask.

Trade safe and keep checking this space for any further updates on developing resistances in between. Also check out our other publications on Nifty, Bank-nifty and other stock specific at the left hand column. You can also visit my masters (Ilango) blog for daily updates on Nifty. Happy Trading. As my mater says, Get Rich Slowly and Quietly. Cheers!!

No comments :

Post a Comment