15/05/2016 08:19 AM IST

In Debtrades, lastweek we discussed that,

In ST I do not see any bullish possibilities. As mentioned in my earlier post on tatamotors, Tata Motors has a resistance at around 416-431 so until unless it move past this resistance zone no bullish possibilities exist.

.......

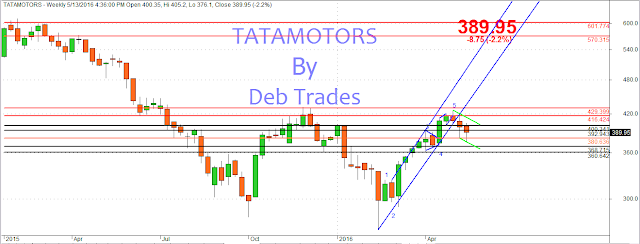

As can be seen from the above Tatamotors Weekly Chart, last week candle has fallen below the rising trend channel which is bearish and can target 368-360 in medium term. Though in short term this can be extremely turbulent because of consolidation as discussed earlier.

.......

Till tatamotors is below 416-431 and above 360-368 it is purely in consolidation zone for positional traders.

Unquote:

For this week lets start with Bullish Possibility.

Bullish Possibility:

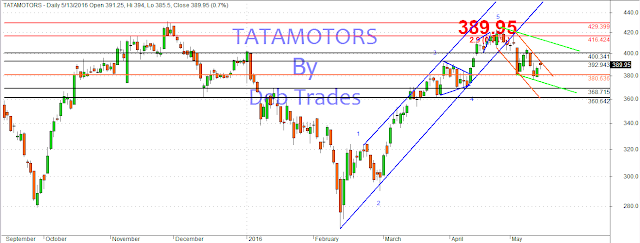

As can be seen from the above daily chart, Tatamotors is currently within the falling trend channels (red and green). So once it is out of the red channel the green channel will resist the up move.

The only hope for a small bullish move exists above 393 (red down trend channel) for a possibility of 412-416 as can be seen from the above hourly chart. At 412-416 it will meet with the green channel resistance so taking 393 as SAR with filter of 2 points, a small long position can be initiated for a target of 412-416. As discussed earlier, decent bull move only above 416-431 for a target of 600 in medium term.

Bearish Possibility:

As can be seen from the above weekly chart last 2 weekly candles has fallen out side of the ascending trend channel which is bearish.

Summary:

1) Taking 393 as the SAR, with 2 points filter a small long position can be taken.

2) Below 393 tatamotors can target 368-360 which is very good support.

3) Decent bull move only above 416-431.

4) Till tatamotors is below 416-431 and above 360-368 it is purely in consolidation zone for positional traders.

5) Below 360-368 it is only sell.

6) Above 416-431 it is only buy.

7) In consolidation buy the dips and sell the tops.

Final words:

If you like this post do share it and leave your comment. Any question related to the topic? Feel free to ask.

Trade safe and keep checking this space for any further updates on developing resistances in between. Also check out our other publications on Nifty, Bank-nifty and other stock specific at the left hand column. You can also visit my masters (Ilango) blog for daily updates on Nifty. Happy Trading. As my master says, Get Rich Slowly and Quietly. Cheers!!

In Debtrades, lastweek we discussed that,

Quote:

In ST I do not see any bullish possibilities. As mentioned in my earlier post on tatamotors, Tata Motors has a resistance at around 416-431 so until unless it move past this resistance zone no bullish possibilities exist.

.......

As can be seen from the above Tatamotors Weekly Chart, last week candle has fallen below the rising trend channel which is bearish and can target 368-360 in medium term. Though in short term this can be extremely turbulent because of consolidation as discussed earlier.

.......

Till tatamotors is below 416-431 and above 360-368 it is purely in consolidation zone for positional traders.

Unquote:

Now let's discussed how this stock performed last week. Tatamotors opened at 400.45, made high at 405.2 and fall to low at 376.1, finally closing at 389.95.

For this week lets start with Bullish Possibility.

Bullish Possibility:

|

| Tatamotors Daily Chart |

|

| Tatamotors Hourly Chart |

Bearish Possibility:

|

| Tatamotors Weekly Chart |

As can be seen from the above weekly chart last 2 weekly candles has fallen out side of the ascending trend channel which is bearish.

Summary:

1) Taking 393 as the SAR, with 2 points filter a small long position can be taken.

2) Below 393 tatamotors can target 368-360 which is very good support.

3) Decent bull move only above 416-431.

4) Till tatamotors is below 416-431 and above 360-368 it is purely in consolidation zone for positional traders.

5) Below 360-368 it is only sell.

6) Above 416-431 it is only buy.

7) In consolidation buy the dips and sell the tops.

Final words:

If you like this post do share it and leave your comment. Any question related to the topic? Feel free to ask.

Trade safe and keep checking this space for any further updates on developing resistances in between. Also check out our other publications on Nifty, Bank-nifty and other stock specific at the left hand column. You can also visit my masters (Ilango) blog for daily updates on Nifty. Happy Trading. As my master says, Get Rich Slowly and Quietly. Cheers!!

No comments :

Post a Comment