Bullish Possibility:

As usual we will start with what we discussed last week.

Quote:

As long as we are above this long term falling trend channel we are safe and above 7972 we could target 8650 in medium term as mentioned in my earlier post.

Unquote:

So let analyze where we are now. As can be seen from the above Nifty Spot Daily chart we are no longer trading above the blue falling trend channel hence bigger bullish move is not possible until unless we are trading within this channel. The upper trendline resistance for this channel comes at around 7865. But this falls withing the Nifty Consolidation zone as marked in chart using a grey rectangle. So until unless nifty moves past 7972 we are not in a bull market but in consolidation zone which is 7575-7972 about 400 points as discussed in my earlier post.

Another small bullish possibility arises if we break above the red resistance line in next week. Let's zoom onto the chart and consider Nifty Hourly chart below.

Risk takers can take a long trade if Nifty move past the red resistance line next week. Currently the resistance is at 7713 but would suggest to go above the break of the previous pivot at 7773. If long taken the position should be maintained with 20 points SAR.

Bearish Possibility:

As can be seen from the above Nifty Weekly Chart the last week candle has fallen out side of the ascending trend channel which is bearish hence can potentially target the base of the breakout bar which is at 7521.

Summary:

1) Below 7773 Nifty is bearish.

2) Above 7773 Bullish attempt can be made but with cautious as 7972 will be the target or next resistance level.

3) Hence if short manage your shorts with 7773 as SAR (stop and reverse) with 20 points filter.

Final words:

If you like this post do share it and leave your comment. Any question related to the topic? Feel free to ask.

Trade safe and keep checking this space for any further updates on developing resistances in between. Also check out our other publications on Nifty, Bank-nifty and other stock specific at the left hand column. You can also visit my masters (Ilango) blog for daily updates on Nifty. Happy Trading. As my mater says, Get Rich Slowly and Quietly. Cheers!!

As usual we will start with what we discussed last week.

Quote:

As long as we are above this long term falling trend channel we are safe and above 7972 we could target 8650 in medium term as mentioned in my earlier post.

Unquote:

|

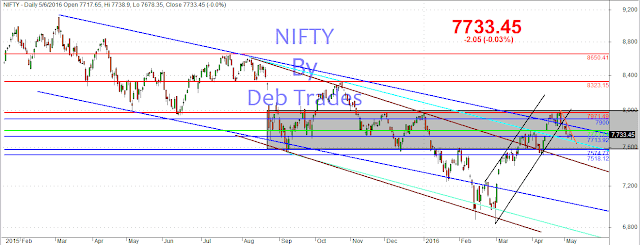

| Nifty Spot Daily Chart |

So let analyze where we are now. As can be seen from the above Nifty Spot Daily chart we are no longer trading above the blue falling trend channel hence bigger bullish move is not possible until unless we are trading within this channel. The upper trendline resistance for this channel comes at around 7865. But this falls withing the Nifty Consolidation zone as marked in chart using a grey rectangle. So until unless nifty moves past 7972 we are not in a bull market but in consolidation zone which is 7575-7972 about 400 points as discussed in my earlier post.

Another small bullish possibility arises if we break above the red resistance line in next week. Let's zoom onto the chart and consider Nifty Hourly chart below.

|

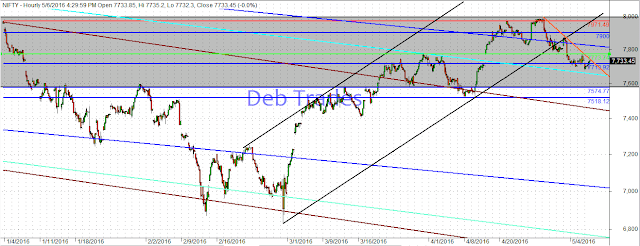

| Nifty Spot Hourly Chart |

Risk takers can take a long trade if Nifty move past the red resistance line next week. Currently the resistance is at 7713 but would suggest to go above the break of the previous pivot at 7773. If long taken the position should be maintained with 20 points SAR.

Bearish Possibility:

| ||||||

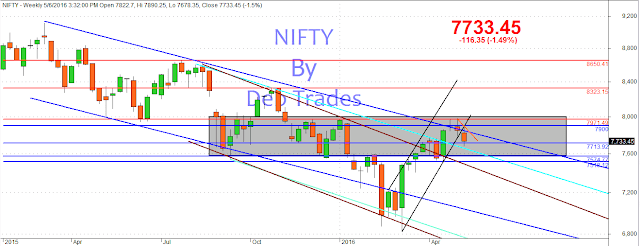

| Nifty Spot Weekly Chart |

As can be seen from the above Nifty Weekly Chart the last week candle has fallen out side of the ascending trend channel which is bearish hence can potentially target the base of the breakout bar which is at 7521.

Summary:

1) Below 7773 Nifty is bearish.

2) Above 7773 Bullish attempt can be made but with cautious as 7972 will be the target or next resistance level.

3) Hence if short manage your shorts with 7773 as SAR (stop and reverse) with 20 points filter.

Final words:

If you like this post do share it and leave your comment. Any question related to the topic? Feel free to ask.

Trade safe and keep checking this space for any further updates on developing resistances in between. Also check out our other publications on Nifty, Bank-nifty and other stock specific at the left hand column. You can also visit my masters (Ilango) blog for daily updates on Nifty. Happy Trading. As my mater says, Get Rich Slowly and Quietly. Cheers!!

No comments :

Post a Comment