15/05/2016 02:11 PM IST

Last week in Debtrades we discussed,

Risk takers can take a long trade if Nifty move past the red resistance line next week. Currently the resistance is at 7713 but would suggest to go long above the break of the previous pivot at 7773. If long taken the position should be maintained with 20 points SAR.

Unquote:

Now let's analyze Nifty for this week. We will start with Bullish Possibility.

Bullish Possibility:

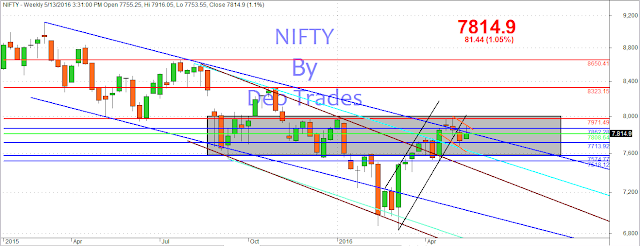

As can be seen from the above chart Nifty is still in the consolidation zone (the grey rectangle) but last week Nifty has painted a bullish candle on the chart though has closed just at the blue resistance line. So for this week if Nifty trades above the falling channel (blue) it will be bullish and can target the upper edge of the consolidation zone which is at 7972 approximately. A successful breakout above 7808 will result in targets like 8323 and 8650 respectively.

Bearish Possibility:

If Nifty fails to float above 7808 then could potentially target the lower edge of the consolidation rectangle which is at 7574. Also as can be seen from the above Daily chart of Nifty, it is currently in a corrective channel (red). If Nifty fails to move past the last week high of 7916 in coming sessions could potentially target the lower edge of the falling channel which is 7620 currently and this will move much lower as the time passes by.

Summary:

1) Till Nifty is below 7972 it is in consolidation phase.

2) No long should exist below 7808. Hence use 7808 as the SAR for your position with a filter value of 20 points.

Final words:

If you like this post do share it and leave your comment. Any question related to the topic? Feel free to ask.

Trade safe and keep checking this space for any further updates on developing resistances in between. Also check out our other publications on Nifty, Bank-nifty and other stock specific at the left hand column. You can also visit my masters (Ilango) blog for daily updates on Nifty. Happy Trading. As my mater says, Get Rich Slowly and Quietly. Cheers!!

Last week in Debtrades we discussed,

Quote:

Risk takers can take a long trade if Nifty move past the red resistance line next week. Currently the resistance is at 7713 but would suggest to go long above the break of the previous pivot at 7773. If long taken the position should be maintained with 20 points SAR.

Unquote:

Last week Nifty opened at 7755, made a low at 7754 and almost immediately moved to 7773. The week high was at 7916 and closed at 7814.9.

Now let's analyze Nifty for this week. We will start with Bullish Possibility.

Bullish Possibility:

| |||||

| Nifty Weekly Chart |

Bearish Possibility:

|

| Nifty Daily Chart |

Summary:

1) Till Nifty is below 7972 it is in consolidation phase.

2) No long should exist below 7808. Hence use 7808 as the SAR for your position with a filter value of 20 points.

Final words:

If you like this post do share it and leave your comment. Any question related to the topic? Feel free to ask.

Trade safe and keep checking this space for any further updates on developing resistances in between. Also check out our other publications on Nifty, Bank-nifty and other stock specific at the left hand column. You can also visit my masters (Ilango) blog for daily updates on Nifty. Happy Trading. As my mater says, Get Rich Slowly and Quietly. Cheers!!

No comments :

Post a Comment